Currently, many crypto enthusiasts are emerging towards Stablecoin and Security tokens. In the crypto industry, startups and entrepreneurs have more interest in buying Stablecoin and Security tokens.

Only some of the Security token development companies provide you with Stablecoin and Security tokens. Because they are built by blockchain technology.

Now, the question is whether the Stablecoin and Security tokens are the same. If not, how are they both different from one another?

In this blog, I have clearly explained how Stablecoin is related to Security tokens.

What is Stablecoin?

A Stablecoin is a cryptocurrency that is pegged into any digital assets. Moreover, Stability is made by pegging the worth of stablecoin to other ‘stable’ assets like fiat currencies, silver, or gold. Most of the stablecoin interlinks to a decentralized organization. So, that organization should be managing the price of assets.

Designing a Stablecoin will stabilize the value of the token and reduce its volatility. So, if you link the Stablecoin with USDT, then the value of the Stablecoin remains the same until the value of the asset changes in the market.

Besides, it is also pegged into gold. Most of the Stablecoin users invested in gold. So, when the price of gold rises then the value of a Stablecoin also rises. While developing a Stablecoin you should decide which asset can back with a Stablecoin.

Moreover, some users find it difficult when they lose their cryptocurrency value on the other day. Because the everyday value or price of crypto may differ in the crypto market. So users started to use Stablecoin so that the value of the coin remains constant based on pegged assets.

What are the Types of Stablecoin?

There are four types of Stablecoins in the crypto market. These Stablecoins are the ones that decide the value. They are,

- Fiat collateralized

- Commodity collateralized

- Crypto collateralized

- Non-collateralized

Highlights of Stablecoin

Some of the highlights of using Stablecoin are

- No volatility

- Liquidity

- Increased revelation

- 100% backed

- Financial enclosure

- Blockchain technology

- Flexible Stablecoin

What is the Security Token?

The security token is far different from utility tokens. So, to create a Security token you should submit your identity, documents, bonds, and other financial assets. But for utility tokens, there is no need for any financial assets. Also, a Security token should satisfy all federal security regulations.

If a token does not satisfy any federal security regulations then the token can not be a Security token. A security token is built to bring trust to investors. So the individual can not cheat the investors. So it’s a major advantage for investors. The security token is not always secure. It may get stolen, lost, and hacked.

Security tokens store personal information or identity electrically. Also, it can act as an additional password to prove the owner’s identity. The only Security token service that can issue a high compact Security token. These tokens derive only from blockchain technology.

The Security token development will be present in both the Security token exchange and the Security token offering website. One can build their Security token offering website quickly with the STO software. It is fast and secure and you can launch your STO website instantly.

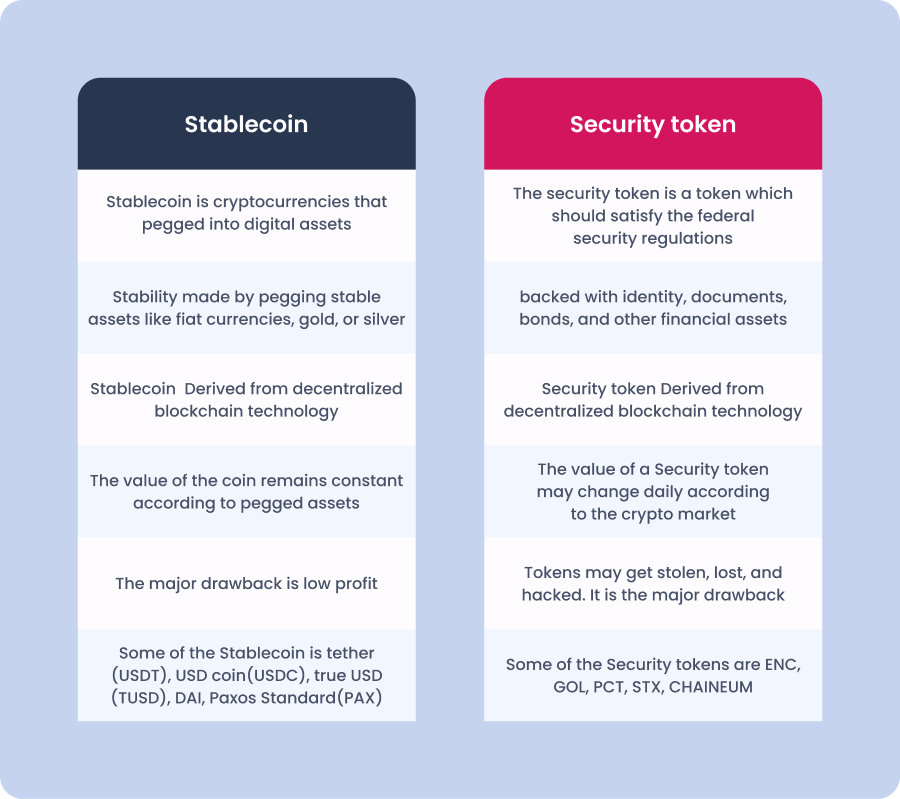

Stablecoin vs Security token

There are some differences between Stablecoin and Security tokens. For your clear understanding here I have a table difference between a Stablecoin and a Security token.

How does Stablecoin relate to Security tokens?

Stablecoin and Security tokens are related in three ways they are

Fiat Collateralized

The simplest scheme in Stablecoin is fiat-collateralized Stablecoin. It backs a token with a 1:1 ratio of cryptocurrency with fiat currency or gold. It acts as a Fiat currency supports centralized issuers and eliminates after receiving the fiat asset. This structure can be easily understood.

The Non-currency extension can be classified as a security token. Eidoo is a Switzerland-based company that has added an ERC-20 token. The token name is ~ Ekon. it is redeemable for one gram of 99.9% fine gold audit within every 90 days.

Ekon derives its value from the value of gold and is also a Security token. This approach describes EKON as a Security token.

Non-Collateralized

It differs from fiat collateralized. Fiat collateralized backs Stablecoin with gold or fiat currency. But non-collateralized Stablecoin does not back with any assets or cryptocurrency. Instead of that, it maintains value by its user’s expectation of maintaining certain values.

The current approach of non-collateralized Stablecoin is seigniorage shares. This share includes the process of issuing bonds and shares, the way they are priced, payment stream, and evaluation. This mechanism is similar to security features.

In this way, Non-collateralized Stablecoin is related to the Security token.

Crypto Collateralized

Here the stablecoin is backed by the crypto assets. True USD, USD tether, and dia are the Stablecoin assets with the Ethereum smart contract. Moreover, Crypto collateralized is backed with crypto assets so the value may change daily.

Collateral creates via a crypto asset, the value of a collateralized asset can represent the fiat value of the Stablecoin. The Stablecoin collateralizes with cryptocurrency assets. A Stablecoin derives its value from a specific asset. In this way, the Stablecoin relates to the Security token

Where can you buy a Stablecoin and Security token?

Being a top-grade Security token development company across the world. expertise in developing a Stablecoin and Security token. So far we delivered more than 50 Stablecoin and Security tokens to our global clients.

Hence, If you are a person looking for the STO website, we people in ICOCLONE will assist you in launching your endemic Security token offering website.

Well if you are into doing business in developing Stablecoin and Security tokens, then keep in touch with us!